SEC EDGAR API in R#

by Adam M. Nguyen

These recipe examples were tested on December 1, 2023.

Documentation:

SEC EDGAR API: https://www.sec.gov/os/accessing-edgar-data

SEC Website Policies: https://www.sec.gov/privacy#security

List of all CIKs: https://www.sec.gov/Archives/edgar/cik-lookup-data.txt

NOTE: Sending more than 10 requests per second will place a temporary IP ban.

See the bottom of the document for information on R and package versions.

Setup#

Load libraries#

Run the following lines of code to load the libraries ‘httr’ and ‘jsonlite’. If you have not done so already, additionally, before the ‘library()’ functions, run ‘install.packages(c(‘httr’,’jsonlite’))’.

# Load necessary libraries

library(httr)

library(jsonlite)

User Info#

The SEC EDGAR API requires you to provide your name and email when sending requests. Simply edit the following variables with your information.

# Designate your user info

firstName <- "First"

lastName <- "Last"

email <- "Email@email.com"

Alternatively, you can also designate environment variables (click here to see how) to access your user information.

# Here we simply use the 'Sys.getenv()' function to grab the variables, first, last, and email

firstName <- Sys.getenv("first")

lastName <- Sys.getenv("last")

email <- Sys.getenv("email")

SEC EDGAR Data Installation#

In addition to the publicly available API, SEC EDGAR data can also be access via a bulk data download, which is compiled nightly. This approach is advantageous when working with large datasets, since it does not require making many individual API calls. However, it requires about 15 GB of storage to install and is more difficult to keep up to date.

To access this data, download the companyfacts.zip file under the ‘Bulk data’ heading at the bottom of this page.

1. Obtaining Marketing Expenses for Amazon#

To access the data from an individual company, we must first obtain its Central Index Key (CIK) value. These values can be obtained by searching for a company here. Alternatively, you can find a list of all companies and their CIK value here.

For this section of the guide, we’ll use Amazon (AMZN) as an example, which has a CIK of 0001018724.

With this CIK, we can now build a URL for the /companyfacts/ endpoint:

# Define the Amazon CIK (Central Index Key) for the SEC EDGAR database

cik <- "0001018724" # Amazon.com Inc.

# Define the URL for the SEC EDGAR API

base_url <- paste0("https://data.sec.gov/api/xbrl/companyfacts/CIK",cik,".json")

# Query SEC EDGAR API

amzn_data <- fromJSON(rawToChar(GET(url = base_url, add_headers("User-agent" = paste0(firstName,",",lastName,", ",email)))$content))

# Let's check the name of the company of the data retrieved

amzn_data$entityName

## [1] "AMAZON.COM, INC."

Now that we’ve retrieved the Amazon’s data, let’s examine their marketing expenses.

# Retrieve marketing expenses in USD

marketing_expenses <- amzn_data$facts$`us-gaap`$MarketingExpense$units$USD

# Filter through marketing expenses to retrieve one cumulative value per Fiscal Year

marketing_expenses_FY <- marketing_expenses[marketing_expenses$fp=='FY',]

marketing_expenses_FY <- marketing_expenses_FY[!is.na(marketing_expenses_FY$frame),]

# Marketing Expenses per Fiscal Year

marketing_expenses_FY[c('frame', 'val')]

## frame val

## 1 CY2007 3.4400e+08

## 7 CY2008 4.8200e+08

## 19 CY2009 6.8000e+08

## 32 CY2010 1.0290e+09

## 45 CY2011 1.6300e+09

## 58 CY2012 2.4080e+09

## 71 CY2013 3.1330e+09

## 84 CY2014 4.3320e+09

## 97 CY2015 5.2540e+09

## 110 CY2016 7.2330e+09

## 123 CY2017 1.0069e+10

## 136 CY2018 1.3814e+10

## 149 CY2019 1.8878e+10

## 162 CY2020 2.2008e+10

## 174 CY2021 3.2551e+10

## 185 CY2022 4.2238e+10

One may be interested in the cumulative sum of the expenses over the years.

# Cumulative sum of marketing expenses over the years

total_marketing_expenses <- sum(marketing_expenses_FY$val)

# Let's take a look

paste0("Amazon's Total Marketing Expenses: ", total_marketing_expenses, ' USD')

## [1] "Amazon's Total Marketing Expenses: 1.66083e+11 USD"

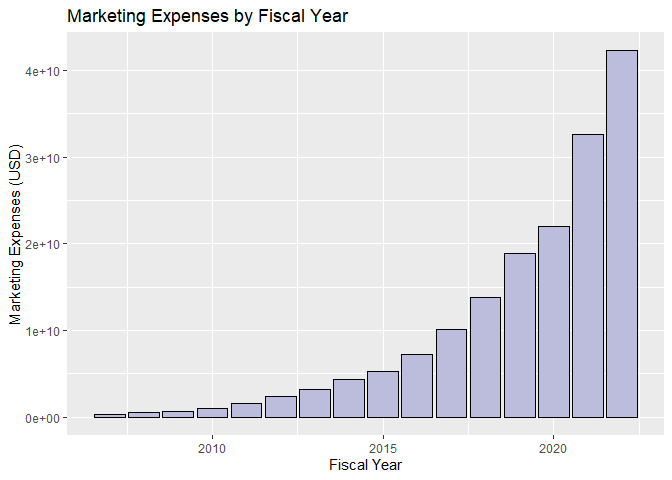

Marketing Expenses Visualization#

Rather than calculating the total marketing expenses documented in the API, let’s visualize the marketing expenses by fiscal year using a box plot.

# Plot marketing expenses by fiscal year

library(ggplot2)

ggplot(data = marketing_expenses_FY, aes(x = as.numeric(substr(marketing_expenses_FY$frame, 3,6)), y = val))+

geom_bar(stat = "identity", fill = "#bcbddc", color = "black") +

labs(x = "Fiscal Year", y = "Marketing Expenses (USD)", title = "Marketing Expenses by Fiscal Year")

3. Comparing Total Assets of All Filing Companies#

The SEC EDGAR API also has an endpoint called /frames/ that returns the data from all companies for a given category and filing period. In this example, we’ll look at the total assets of all companies reported for Q1 2023.

# Specify query parameters

category <- "Assets/USD"

year <- "2023"

quarter <- "1"

# Define URL

base_url <- paste0('https://data.sec.gov/api/xbrl/frames/us-gaap/',category,'/CY',year,'Q',quarter,'I.json')

# Query API

asset_data <- fromJSON(rawToChar(GET(url = base_url, add_headers("User-agent" = paste0(firstName,",",lastName,", ",email)))$content))$data

# For this usecase we are only interested in the 'entityName' and 'val' columns so let's subset

asset_data <- as.data.frame(cbind(asset_data$entityName, asset_data$val))

# Rename columns

colnames(asset_data) <- c('Company', 'totalAssets')

# Coerce the 'totalAssets' column to numeric

asset_data$totalAssets <- as.numeric(asset_data$totalAssets)

# Let's see how many entries were retrieved

nrow(asset_data)

## [1] 6220

# We can also see the structure of the data retrieved using the 'str()' function

str(asset_data)

## 'data.frame': 6220 obs. of 2 variables:

## $ Company : chr "AAR CORP" "ABBOTT LABORATORIES" "WORLDS INC." "ACME UNITED CORP" ...

## $ totalAssets: num 1.67e+09 7.38e+10 8.07e+04 1.57e+08 3.72e+08 ...

# Finally, let's see the first few entries of asset_data

head(asset_data)

## Company totalAssets

## 1 AAR CORP 1673300000

## 2 ABBOTT LABORATORIES 73794000000

## 3 WORLDS INC. 80675

## 4 ACME UNITED CORP 157468000

## 5 ADAMS RESOURCES & ENERGY, INC. 371563000

## 6 BK TECHNOLOGIES CORPORATION 50758000

Export to CSV#

Commonly users may want to export data into a comma seperated file (.csv), this may be achieved as follows:

# Export as a csv

write.csv(asset_data, file = paste0('companies_by_total_assets_q',quarter,'_',year,'.csv'))

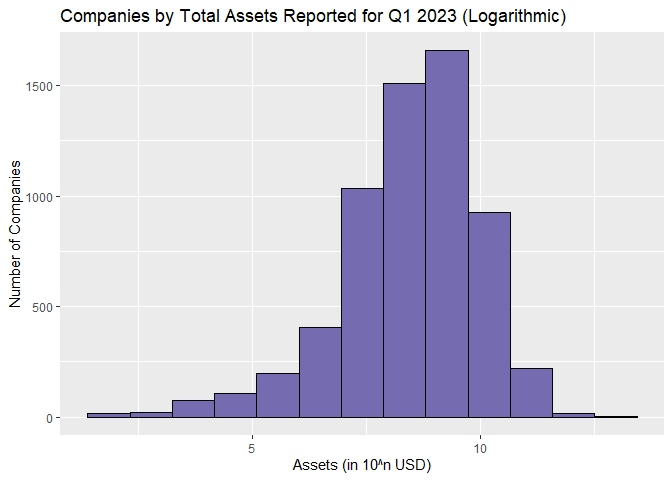

Total Assets of All Companies Histogram#

Since the total assets of all companies is a dataset that ranges from values as low as zero to those as large as 4.3 trillion, these values must be graphed logarithmically. Below, we take the log10 of the ‘totalAssets’ column, luckily R makes this very easy for us.

# Load the ggplot2 library

library(ggplot2)

# Plot Histogram of totalAssets with log10 transformation

ggplot(asset_data, aes(x = log10(totalAssets))) +

geom_histogram(bins = (10%%max(asset_data$totalAssets) +3), fill = "#756bb1", color = "black") +

labs(title = "Companies by Total Assets Reported for Q1 2023 (Logarithmic)",

x = "Assets (in 10^n USD)",

y = "Number of Companies")

## Warning: Removed 30 rows containing non-finite values (`stat_bin()`).

4. Finding the Top 500 Companies by Revenue#

The Fortune 500 is a ranking of the top 500 companies by revenue, according to the data filed in their 10-K or a comparable form. In this example, we’ll look at only the revenues reported in the 10-K forms to construct a similar ranking of U.S. companies by revenue.

# Define query and parameters

category <- 'Revenues/USD'

year <- '2022'

url <- paste0('https://data.sec.gov/api/xbrl/frames/us-gaap/',category,'/CY',year,'.json')

# Query API

data_retrieved <- fromJSON(rawToChar(GET(url = url, add_headers("User-agent" = paste0(firstName,",",lastName,", ",email)))$content))$data

# Display number of results

nrow(data_retrieved)

## [1] 2433

# Grab only first 500 highest revenues

top500_revenues <- head(data_retrieved[order(-data_retrieved$val), c('entityName', 'val')], n = 500)

# Let's see the first 10 entries in the top500_revenues

head(top500_revenues, n = 10)

## entityName val

## 214 WALMART INC. 6.11289e+11

## 72 Exxon Mobil Corporation 4.13680e+11

## 320 UnitedHealth Group Incorporated 3.24162e+11

## 128 CVS HEALTH CORP 3.22467e+11

## 776 BERKSHIRE HATHAWAY INC 3.02089e+11

## 188 Chevron Corp 2.46252e+11

## 909 CENCORA, INC. 2.38587e+11

## 562 COSTCO WHOLESALE CORP /NEW 2.26954e+11

## 294 Cardinal Health, Inc. 1.81364e+11

## 1992 The Cigna Group 1.80516e+11

Export to CSV#

# Export to csv

write.csv(top500_revenues, file = paste0('top_500_companies_by_revenue_fy',year,'.csv'))

R Session Info#

sessionInfo()

## R version 4.3.1 (2023-06-16 ucrt)

## Platform: x86_64-w64-mingw32/x64 (64-bit)

## Running under: Windows 10 x64 (build 19045)

##

## Matrix products: default

##

##

## locale:

## [1] LC_COLLATE=English_United States.utf8

## [2] LC_CTYPE=English_United States.utf8

## [3] LC_MONETARY=English_United States.utf8

## [4] LC_NUMERIC=C

## [5] LC_TIME=English_United States.utf8

##

## time zone: America/Chicago

## tzcode source: internal

##

## attached base packages:

## [1] stats graphics grDevices utils datasets methods base

##

## other attached packages:

## [1] ggplot2_3.4.4 jsonlite_1.8.7 httr_1.4.7

##

## loaded via a namespace (and not attached):

## [1] vctrs_0.6.3 cli_3.6.1 knitr_1.44 rlang_1.1.1

## [5] xfun_0.40 generics_0.1.3 labeling_0.4.2 glue_1.6.2

## [9] colorspace_2.1-0 htmltools_0.5.6.1 sass_0.4.7 fansi_1.0.4

## [13] scales_1.2.1 rmarkdown_2.25 grid_4.3.1 evaluate_0.22

## [17] munsell_0.5.0 jquerylib_0.1.4 tibble_3.2.1 fastmap_1.1.1

## [21] yaml_2.3.7 lifecycle_1.0.3 compiler_4.3.1 dplyr_1.1.3

## [25] pkgconfig_2.0.3 rstudioapi_0.15.0 farver_2.1.1 digest_0.6.33

## [29] R6_2.5.1 tidyselect_1.2.0 utf8_1.2.3 pillar_1.9.0

## [33] curl_5.1.0 magrittr_2.0.3 bslib_0.5.1 withr_2.5.0

## [37] tools_4.3.1 gtable_0.3.4 cachem_1.0.8